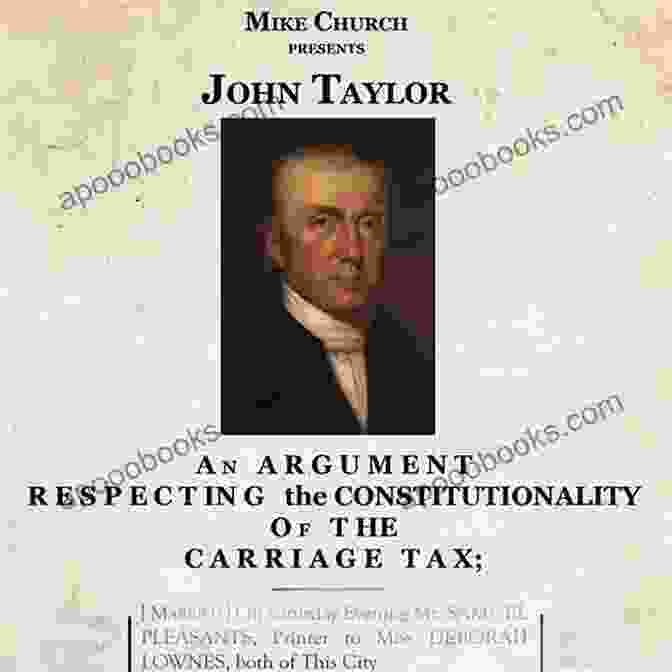

Unveiling the Constitutional Debate: An In-Depth Analysis of "An Argument Respecting The Constitutionality Of The Carriage Tax"

In the annals of American jurisprudence, the debate over the constitutionality of the Carriage Tax stands as a pivotal chapter, marking a profound clash between the principles of federalism and the taxing power of the government. Published in 1814, "An Argument Respecting The Constitutionality Of The Carriage Tax" by Daniel Webster emerged as a seminal work that ignited a fierce intellectual and political battle over the limits of federal authority. This comprehensive article delves into the intricate arguments and historical context of this landmark book, shedding light on its enduring impact on American constitutional law.

4.4 out of 5

| Language | : | English |

| File size | : | 2916 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 46 pages |

| Lending | : | Enabled |

The Historical Context: A Nation on the Brink

The early 19th century witnessed a tumultuous period in American history. The War of 1812 had just concluded, leaving the young nation grappling with a surge in debt and a pressing need for funds. In response, the federal government under President James Madison imposed a series of taxes, including the unpopular Carriage Tax, which levied an excise duty on carriages and vehicles.

This tax sparked widespread opposition, particularly among wealthy landowners and merchants who viewed it as an infringement on their property rights. They argued that the tax violated the Constitution's Tenth Amendment, which reserved certain powers to the states and limited the federal government's authority.

Daniel Webster: A Constitutional Champion

Enter Daniel Webster, a brilliant orator and legal scholar who emerged as the leading advocate for the Carriage Tax's constitutionality. Born in 1782 in New Hampshire, Webster possessed a profound understanding of the law and a deep reverence for the American Constitution.

In his "Argument Respecting The Constitutionality Of The Carriage Tax," Webster presented a compelling case for the federal government's power to impose excise taxes. He contended that such taxes fell within the broad authority granted by the Constitution's Article I, Section 8, which empowered Congress to "lay and collect taxes, duties, imposts, and excises."

The Elastic Clause: A Key Interpretation

Webster's argument hinged on his interpretation of the Constitution's so-called "Elastic Clause," which permits Congress to make all laws "necessary and proper" for carrying out its enumerated powers. Webster argued that the government's need for revenue to fund essential activities, such as national defense, provided the necessary justification for the Carriage Tax.

He further asserted that the tax was uniform and equitable, not favoring one group over another, and that it did not discriminate against any particular state or region. Thus, Webster contended, the tax was a legitimate exercise of federal authority.

The Opposition's Counterarguments: States' Rights

Webster's arguments were met with fierce resistance from those who opposed the Carriage Tax. They maintained that the tax exceeded the Constitution's limitations on federal power and infringed on the sovereignty of the states. States' rights advocates argued that the Carriage Tax was a direct tax, which the Constitution prohibited the federal government from imposing without apportioning it among the states.

Furthermore, they contended that the tax was unnecessary and oppressive, as the government had sufficient revenue from other sources. The opponents of the tax saw it as a dangerous precedent that would erode the powers reserved to the states.

The Supreme Court's Decision: A Landmark Ruling

The debate over the Carriage Tax ultimately reached the Supreme Court, which issued its landmark decision in the case of Hylton v. United States in 1796. In a 4-3 ruling, the Court upheld the constitutionality of the tax, adopting many of Webster's arguments.

The Court held that the Carriage Tax was an excise tax, not a direct tax, and that it was therefore within the federal government's authority to impose. Additionally, the Court ruled that the tax was not oppressive or discriminatory, and that it was necessary to meet the government's financial needs.

An Enduring Legacy: Shaping Constitutional Law

"An Argument Respecting The Constitutionality Of The Carriage Tax" remains a seminal work in American constitutional law, establishing important principles that continue to shape the debate over the limits of federal power today. Webster's arguments for the federal government's broad taxing authority have been cited in numerous Supreme Court decisions, including the landmark McCulloch v. Maryland case of 1819.

The book also contributed to the development of the theory of implied powers, which holds that the federal government possesses powers that are not explicitly enumerated in the Constitution but are necessary to carry out its delegated powers. This theory has played a significant role in expanding the scope of federal authority over time.

Daniel Webster's "An Argument Respecting The Constitutionality Of The Carriage Tax" stands as a testament to the enduring importance of the American Constitution and the ongoing debate over federalism. Webster's brilliant arguments and the Supreme Court's subsequent decision in Hylton v. United States laid the foundation for a broad interpretation of the Constitution's taxing power, while also recognizing the limits of federal authority.

As the United States continues to grapple with complex constitutional issues, the legacy of "An Argument Respecting The Constitutionality Of The Carriage Tax" serves as a reminder of the intricate balance between national power and state sovereignty that has shaped the American legal and political landscape for centuries.

4.4 out of 5

| Language | : | English |

| File size | : | 2916 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 46 pages |

| Lending | : | Enabled |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Roxanne Langley

Roxanne Langley Fiona Baker

Fiona Baker Susie Tate

Susie Tate Karen Kingsbury

Karen Kingsbury Stacy Overby

Stacy Overby Flora Larsson

Flora Larsson Sheldon Cole

Sheldon Cole Vanessa Kind

Vanessa Kind Robert Palmer

Robert Palmer Voddie Baucham Jr

Voddie Baucham Jr Us Army

Us Army Yuri Futanari

Yuri Futanari Timothy Brantley

Timothy Brantley Sassafras Lowrey

Sassafras Lowrey Paul Nathanson

Paul Nathanson Simple Scores

Simple Scores William Agunwa

William Agunwa Stephen F Jones

Stephen F Jones Rosie Clarke

Rosie Clarke Lee Everett

Lee Everett

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Joseph HellerUnveiling the Enchanting World of the Bridgertons: Dive into the First Three...

Joseph HellerUnveiling the Enchanting World of the Bridgertons: Dive into the First Three...

Edward ReedOpening The Long Time Dying: A Private Investigator Crime Thriller That Will...

Edward ReedOpening The Long Time Dying: A Private Investigator Crime Thriller That Will... Dean ButlerFollow ·15.1k

Dean ButlerFollow ·15.1k Drew BellFollow ·9.3k

Drew BellFollow ·9.3k Fredrick CoxFollow ·8.6k

Fredrick CoxFollow ·8.6k W.H. AudenFollow ·8.3k

W.H. AudenFollow ·8.3k Jeremy MitchellFollow ·5.3k

Jeremy MitchellFollow ·5.3k Herbert CoxFollow ·10.3k

Herbert CoxFollow ·10.3k Edmund HayesFollow ·13.6k

Edmund HayesFollow ·13.6k Grayson BellFollow ·19.8k

Grayson BellFollow ·19.8k

Harry Cook

Harry CookRape Blossoms and White Sky: A Floral Symphony of...

A Kaleidoscope of Colors...

Vic Parker

Vic ParkerThe Passion of Jovita Fuentes: Unveiling the...

Immerse yourself in the...

Cormac McCarthy

Cormac McCarthySinners and Saints: A Dark New Adult High School Bully...

Sinners and Saints is...

4.4 out of 5

| Language | : | English |

| File size | : | 2916 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 46 pages |

| Lending | : | Enabled |